K. and I visited the Carnegie Museum of Art this afternoon after brunch at Kiva Hahn. As a working artist, I am quite guarded about when and where I see new art - the secret conversation that I have with my own artwork can be interrupted by the 40-100 voices that jump in when I go to see work in a museum setting, polluting the in-studio dialogue.

But. It was time. I had to get a look at the International before it takes off. And then there was the pleasant surprise of Worlds Away, a show about suburban architecture.

That's where I'll start, with all my illegal, copyright-violating, guard-pissing-off in-Museum phone photography.

REASON 1 : AUTOBIOGRAPHY OF A SUBURBAN MALL

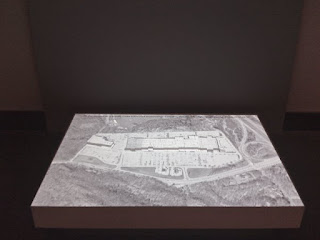

A powerpoint with voiceover projected on the semi-topographical map of a mall in Fishkill.

REASON 2 : THE JUXTAPOSITION OF ED RUSCHE'S PARKING AERIAL PARKING LOT PHOTOS WITH AERIAL PHOTO OF HUMAN INTERVENTIONS IN RURAL LANDSCAPES.

The guard was too close, no pictures. You'll have to just go visit.

REASON 3 : COMING OUT OF THE SCAIFE GALLERY TO THE DARKENED HALL OF ARCHITECTURE

REASON 4 : ALL THE INSTALLATIONS IN 'LIFE ON MARS' BUT ESPECIALLY THIS ONE.

Its made of thread and wax, by someone with an Indian name. Stunning.

You'll notice I make no mention of all the wall text and heady theory etc. The work, overall, is beautiful, if, for the most part, on the clinical side. Mario Merz condenses language into an object better than anyone, and still riffs on fibbonacci numbers with neon. Lots of graffitti-influenced surface-vs-surface, some giving the Museum halls pregnant walls ... whatev... I'm way more interested in --

REASON 5 : PIRANESE'S DRAWINGS OF IMAGINARY PRISONS IN THE WORKS ON PAPER GALLERY

WTF??? These drawings and etchings are magnificent mental landscapes of imaginary penury. In Piranese's incredible draftsmanship. Oh god, the torturous details ... The CMA provides big magnifying glasses, too, to let you examine stroke by stroke the master drawings of piers with people strapped to pillars and suspended cages. Not to mention his stray line drawing in pen and ink of a lady with chained wrists facing the viewer, and random domestic exchange happening behind her.

RUNNER UP : In every third gallery, a dad asking a guard, "Where's the dinosaurs?"

BONUS ROUND : Friedrich Kunath inherits Miro and Klee's strange-map draw/paint technique. Intimate. The lines get a little soft, turning things towards nostalgia in general, and he has his moments of clumsiness. But it works in creating painting that is not an argument (for once) but is instead a collection of natural gestures, a private language accessible enough to be public.